This is part two of "The Ultimate Pitch Deck Guide for Startups," a fundraising guide made in partnership with DECKO, a leading pitch deck development company that’s helped ~180 startups raise over $100M from investors.

____________________

Now that you have a clear understanding of the different types of investors you’ll meet and how to tailor your pitch deck for each, you’re ready to dive into the different contexts in which your deck will be viewed.

In the fast-paced, dynamic world of fundraising, you can meet investors anywhere and through anyone, so having the right deck at the right time is crucial for making the best impression possible.

In this installment of "The Ultimate Pitch Deck Guide For Startups," we’ll discuss three important decks for you to have: your "Teaser Deck," "Comprehensive Deck," and "Public Presentation Deck." You’ll also see the same slide (Revenue Growth) in all three decks so you can see what we’re talking about in action.

Your Teaser Deck serves as a captivating introduction, enabling you to pique investor interest before a meeting, enticing them to learn more. Your Comprehensive deck is a comprehensive document shared with investors after the meeting, providing a detailed overview of your startup, including market analysis, financial projections, and competitive advantages. Lastly, your Public Presentation deck acts as a visual aid during presentations, allowing you to engage with the audience, highlight key points, and emphasize your unique value proposition.

By adapting the content and format of your pitch deck to these different contexts, you can effectively communicate your vision, demonstrate credibility, and maximize your chances of securing investment.

Now, let’s dive in.

Teaser Deck

What it is and how it is viewed

Your teaser deck is a short overview of your company developed specifically for the purpose of garnering initial interest from potential investors. This deck is most commonly viewed before your meeting with investors. Often this deck will be passed around from investor to investor. Investors love to share deals with each other and get feedback.

Investors will likely view this deck while in the middle of doing something else (sometimes even in the corner of their screen while they are on a video call with another company) and they will make quick decisions as to whether they want to move forward with a meeting. If they’re interested, they’ll respond to request a meeting. If they are not interested, they will either respectfully decline or you may never hear from them again.

In many ways, your teaser deck will be your first impression with investors.

What to include in your teaser deck

Since this deck is viewed before they meet with you, your deck must do the talking when you’re not in the room. You need to clearly outline what your company does in a manner that is easy to understand. Avoid complicated buzzwords, abbreviations, etc., so that investors do not find themselves confused. If they are confused for even a moment, they will lose interest and move on, leaving your company in the dust.

Since investors make snap judgements on your deck, hook them early and hook them often. Jump right into what makes your company unique and how well you are performing. Talk about your traction, team, and product before diving into the more academic parts of your business case (market characteristics, competitive overview, etc.). This may sound counterintuitive to every pitch deck template you found elsewhere, but if investors do not see that your company is worth the time to review, they will skip over it.

Be sure to include as many product images, customer quotes, and social proof as possible to bring your company to life since you won’t be present to talk about it and deliver the passion you already have about your company.

Lastly, remember to keep this version of your deck high-level. This is the version of your deck that will live on the internet (forwarded between investors, viewed on investment platforms, etc.), unbound by NDAs or even a relationship built on trust. Expect any information in this deck to be flipped directly to the CEO of your biggest competitor.

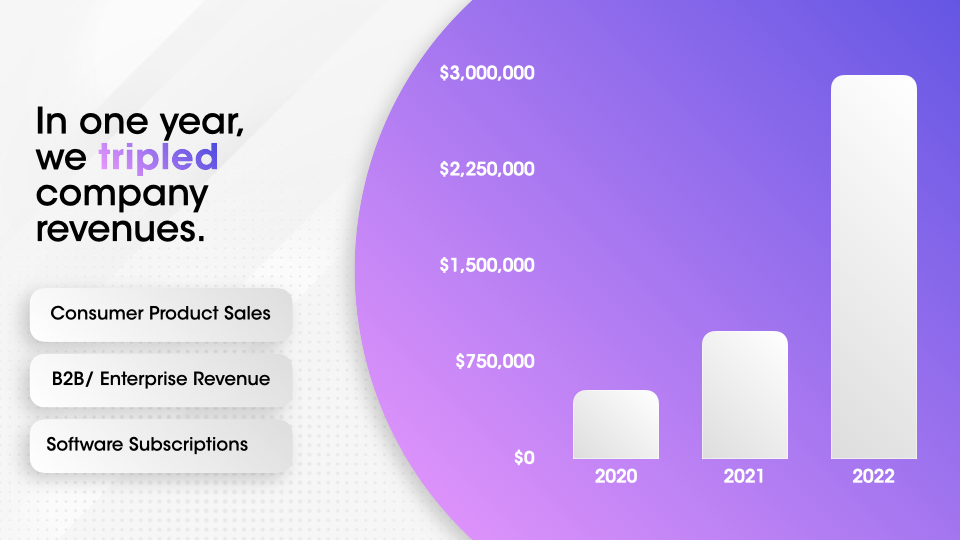

In this example, we see clear proof that the company is performing well with an exciting revenue ramp that highlights 3x YoY growth. Additionally, we see that the company has three separate revenue streams that suggest strong revenue diversification. What we don’t see is exactly what the breakdown of revenues is by revenue model or what they expect to do this year in revenue. This information is enough to garner investor interest without giving away too much information.

The most important message investors should walk away with is, "Woah! This business is performing really well, has a great product, and has an excellent team - I want to take a meeting with them."

Comprehensive Deck

What it is and how it's used

Your Comprehensive deck is the most detailed version of your pitch deck. This is the version of your deck you share with investors after your meeting so they can make an informed decision about whether or not to move forward with investing in your company (sometimes with an accompanying data room).

Investors will use this deck as a jumping-off point for due diligence and VC’s will use it to build their investment memos to circulate within their firms. Some Angel Investors may even make their final investment decision based on the contents of this deck.

This version will be the wordiest version of your deck and will serve as the best representation of your company.

What to include in your comprehensive deck

Since this is the deck investors will use to make an informed investment decision, it is also your opportunity to control the narrative.

Use your company’s numbers, customers, and team to create a sense of inevitability about your company’s success. Investors should feel your company is going to succeed with or without their capital and that this is their opportunity to get involved before it’s too late.

Dive into your unit economics and put it all on the table - your margins, Customer Acquisition Cost, Customer Lifetime Value, Retention, and everything else relevant to your company’s path to profitability. By this point, you should have an established relationship built on trust with your potential investor, so you can feel comfortable going into detail.

Additionally, this is the deck to talk about your company’s proprietary advantages. This can include information on your company’s intellectual property, future plans, flywheel, growth strategy, and more.

You may also send this deck with an accompanying data room. In those cases, add links to your deck to access specific files in your data room (for this example we added a link to the company’s comprehensive financial model) so investors can access supplementary information while staying in flow with your story.

Different investors, depending on their due diligence processes, may make their investment decisions based on different factors, including your tech stack, financials, team bios, and more. You don’t have to include all of these in your pitch deck, but it is best to have slides for these ready to share. In other words, you will have many different versions of this pitch deck and should share the right one with investors based on what they ask for.

There are some factors in reviewing your business that are outside of your direct control, including your market characteristics, competition, and likelihood for an exit. However, these are equally as important as your company’s performance towards an investor’s final decision. For these slides, provide as much research as possible (including your sources).

For your market characteristics, investors should have a clear understanding of who your customers are and how they make decisions. In addition to your Total Addressable Market, Serviceable Addressable Market, and Share of Market, share details about what matters to your customers along with how your market has evolved over time (new technologies that allow your company to succeed, favorable regulation, etc.). Additionally, include information on your strategy to grow within your market.

For your competitive analysis, be transparent about where you are stronger or weaker than your competitors. Remember, while your deck controls the narrative, investors will do their own due diligence, so you don’t want to be in a position that suggests you do not understand your competitors.

For the likelihood to exit, provide information on companies that are similar to yours that have yielded outsized investor returns in the past. This could include M&A activity, IPOs, large valuations, and more. Investors will use this to understand what an exit for your company could look like, assuming everything goes according to plan.

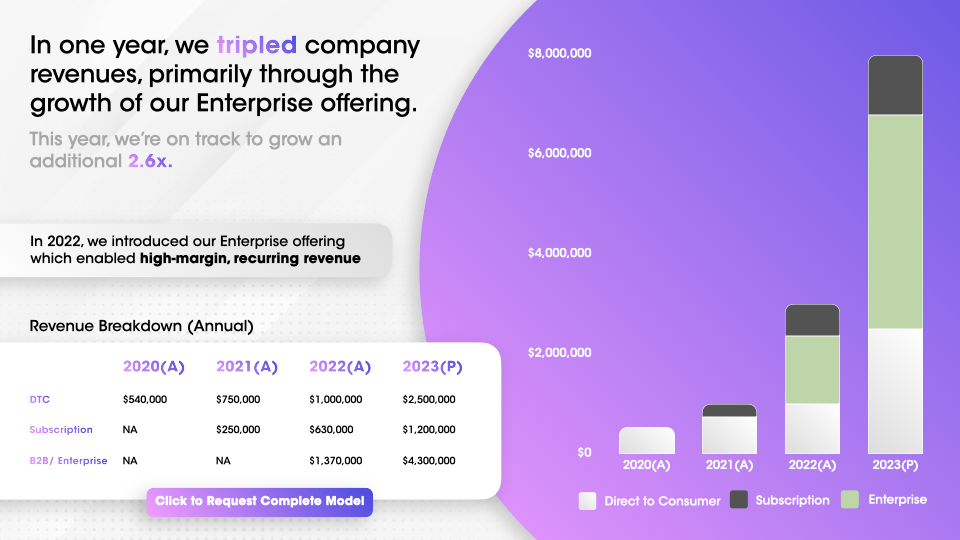

In this example, you can see significantly more detail about the company along with their projections for this year (something that was not included in the other versions of the deck). Additionally, there is information about how the company’s B2B offering will drive growth in the future, along with a link to request a detailed financial model from your company.

Investors should walk away from this deck feeling as if your company is on the fast track towards success with a clear understanding of the market it is operating in.

Public Presentation Deck

What it is and how it's used

Your Public Presentation deck is the most content-light version of your deck. It is developed to accompany you as you talk through the details of your company. This is the version of your deck used in public presentations, video calls with investors, and anywhere else where you are speaking with accompanying slides.

This deck is your opportunity to engage your audience, so be sure that while the slides are visually appealing, the attention remains on you as the speaker.

What to include in your public presentation deck

In this deck, words are an absolute last resort when visuals don’t get your point across. Keep the content of your deck as light as possible so that your audience is focused on you.

Be sure to include as many product images, videos, and graphs as you can. Include no more than a sentence of text on every slide if possible. You can include as many slides as you would like, provided each of the slides is content-light and serves the point you are making live.

Additionally, since this deck is part of a live presentation, you can use some slides to "break the fourth wall" and engage directly with your audience. Questions to the audience, polls, personal anecdotes, etc., can go a long way toward reeling your audience in and keeping them retained throughout the course of your presentation.

In this example, we see limited written content along with a graph and a big number so the audience always has a reference point to accompany what the speaker is saying.

The audience should walk away from this experience feeling connected to you as the speaker and visually supported by the slides you created.

____________________

While each of these decks will change depending on your audience (SEE: "The Different Investors You’ll Meet and How to Tailor Your Pitch Deck for Each"), these three decks are key to include in your arsenal as you go through your fundraising journey.

Next up, we’ll run through all of the venture capital vocabulary and how to use it in your pitch deck.