Rejected From YC? These 5 YC Alternatives Let You Pitch to Many VC’s at Once

It might feel like a punch in the gut when you find yourself at the receiving end of a 'no' from Y Combinator. After all, you've poured your heart and soul into this world-changing idea of yours. But remember. rejection from YC isn't a comment on your personal worth. It's merely a business decision that didn't swing your way.

As an entrepreneur, you're uniquely positioned to do something most people can't — turn a simple, practical, and fundable idea into a successful business. And if there's one trait you need during your entrepreneurial journey, it's to be relentless.

Who says a 'no' from YC is the end of the road? We’ve put together five fantastic alternatives to Y Combinator that might just be the perfect launchpad for your startup.

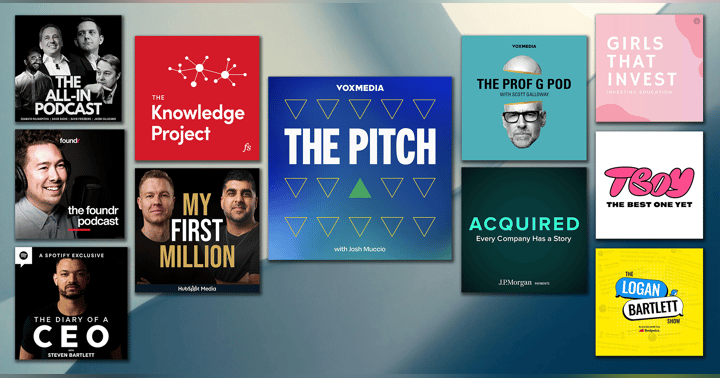

1. Pitch the VC’s on The Pitch

At its core, The Pitch is about showcasing and refining ideas. Entrepreneurs get to present their startups to a panel of 5 world-class investors who provide real-time feedback. It's like a friendly Shark Tank. The Pitch aims simply to document the fundraising process authentically, not manufacture drama. The VCs on The Pitch have invested over $10 million in the startups featured on the podcast.

To apply to pitch, all you need is a pitch deck. The team behind The Pitch podcast and VC fund is specifically looking for companies at the pre-seed and seed stage.

2. Seed Checks

Sometimes simplicity is key. And when it comes to funding platforms, Seed Checks is a breath of fresh air. No fanfare, no theatrical presentations – just you, your deck, and a group of investors eagerly scrolling through to find the next big thing.

Seed Checks provides a great opportunity to pitch your startup to many VCs all at once. When you pitch your idea to multiple investors simultaneously, you’re more likely to reach one who believes in your idea and is willing to fund it.

Your startup needs to fit within a certain valuation range - ideally, around $20 million or below. In terms of geography and sectors, while they cover a broad range, they do have a bias towards US startups and tend to shy away from consumer packaged goods or direct-to-consumer goods.

While Seedchecks may not provide feedback, the exposure to a pool of investors and the experience of submitting a pitch deck is invaluable in itself. If you’re looking for a simple, streamlined, and efficient way to connect with investors, consider giving it a shot.

3. DealflowDigest

Imagine if you could subscribe to a service that delivers potential investors straight to your inbox. Dealflow Digest is exactly that — a curated newsletter that's all about connecting startups with potential investors.

Dealflow Digest comes from a group of VCs who wanted to change the way startups and investors find each other. This platform allows you to skip the line and get your pitch directly into the hands of individuals who are actively seeking investment opportunities.

When you apply, your startup is included in their weekly digest, which is sent directly to investors actively looking for investment opportunities. The digest is also available on their website, which increases your visibility and potential reach.

Keep in mind that Dealflow Digest is looking specifically at European startups with a robust business plan and vision. They prefer startups looking for seed or Series A funding.

4. Startup-Investor Matching Tool

The Startup-Investor Matching Tool is a platform designed to connect founders to potential investors. It uses a curated list of over 600 pre-seed and seed-stage investors.

The Tool aligns founders with suitable investors based on certain key criteria, making sure there’s a compatibility between the investor's expectations and your startup's vision, stage, and sector — just like a data-driven dating app.

Applying to this platform is as straightforward as it gets: fill out a form detailing your startup's specifics, and let the tool take care of the rest.

5. Seedscout

Similarly, Seedscout connects early-stage companies with investors actively looking for new business ventures. You can submit your pitch deck and other relevant details about your startup, and Seedscout's team reviews it and shares it with their network of investors if they think it’s promising.

Seedscout operates as a discovery platform. It's an opportunity to be spotted, even if you're tucked away in a corner of the world where venture capitalists rarely go. The process is as simple as signing up and submitting information about your startup. If your pitch deck captures their attention, they'll include you in their weekly list of top startups, which exposes your idea to an array of investors looking for their next venture.

So if you're an early-stage founder looking to break free from the confines of your immediate network and step onto a global stage, Seedscout might be the platform to consider.

Over and Out!

And there you have it, dear relentless entrepreneurs! Five alternatives to Y Combinator that are ready to provide you with the support, exposure, and guidance your startup needs to soar. Remember, the journey of entrepreneurship isn't a sprint but a marathon, and getting rejected from YC doesn't mean you're out of the race.