Hardware Startup Playbook: 6 Key Decisions That Matter

"Anything that's hard to do is hard to disrupt," says Mike Burton, founder of Lockstop. His smart bike lock startup exemplifies the challenging but rewarding path of building a hardware company. Here's what we can learn from their journey.

1. Setting Strategic Investment Thresholds

In a bold move during his pitch, Burton declined a $50k investment offer, stating "we don't allow any investments under 100k." While this might seem counter-intuitive for an early-stage startup, it reflects a strategic choice to maintain a focused cap table with deeply committed investors.

This approach has trade-offs:

- Pros: Fewer investors to manage, higher commitment levels

- Cons: Potentially missing valuable strategic angels, limiting network effects

2. Unit Economics & Pricing Strategy

Lockstop's pricing model shows careful consideration of both immediate revenue and long-term sustainability:

- One-time fee: $750 per device

- Annual data revenue: ~$750 per device

- Current manufacturing cost: $600

- Future target cost: $300 (70% reduction through redesign)

Instead of charging riders, they sell to cities, eliminating accessibility barriers while creating a sustainable revenue stream through data monetization.

3. City Partnership Strategy

Burton's approach to city partnerships is methodical:

- Target cities: 100,000-150,000 population

- Deployment ratio: 100 devices per 150,000 residents

- Funding approach: Leveraging federal grants and EPA funding

- Data incentives: Providing cities with valuable mobility insights

4. Product Development Decisions

Lockstop's product strategy balances core functionality with valuable add-ons:

- Basic function: Secure bike locking

- Smart features: IOT connectivity, usage tracking

- Environmental sensors: Weather and climate monitoring

- Security: Tamper detection and alerts

5. Manufacturing & Cost Optimization

Current manufacturing approach:

- Small batch production in Northwest Arkansas

- 8-week manufacturing cycle

- Focus on quality over immediate scale

- Clear path to cost reduction through redesign

6. Growth & Scale Planning

Lockstop's growth targets are ambitious but structured:

- 5-year goal: Expand to 291 cities

- Revenue target: $60M in 5 years

- Break-even timeline: 24 months

- Initial focus: 5 cities for proof of concept

Key Takeaways

- Set clear boundaries early - even if it means saying no to investors

- Focus on unit economics before scale

- Build strategic partnerships with clear value propositions

- Balance feature set with manufacturing capabilities

- Have a clear path to cost reduction

- Start small but plan for scale

As Burton says, "Everything always sells itself when it's there." The key is getting there with the right decisions at each step.

When The Perfect Pitch Goes Sideways

When Anastasia Trofimova walked into The Pitch Room she had everything going for her...Anastasia had the VCs wrapped around her finger. Three offers, from three VCs. Totaling over $1 million.And yet... she walked away with nothing in the e…

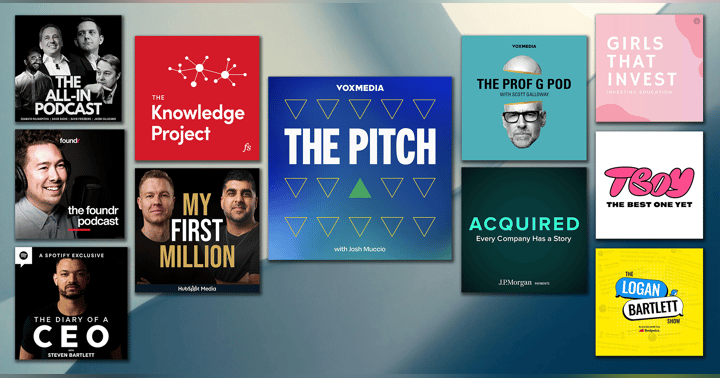

What are the best business podcasts in 2025?

Welcome to 2025, where business podcasting has evolved into must-watch TV. YouTube has dethroned traditional podcast platforms, transforming the medium into a visual-first experience. The podcasts that made this list aren't just keeping up – t…